Keeping up with the Carbon Market – March 2024

Keeping up with the Carbon Market – March 2024

Keeping up with the Carbon Market – March 2024

MONTHLY RECAP

March 29, 2024

Grace Lam

·

Co-founder

Mar Velasco

·

Co-founder

The voluntary carbon market is evolving daily, and we know can be difficult to stay up-to-date. We've got you covered! We're launching this monthly series to keep you posted on the latest updates and research we come across in the market. Whether you're a carbon project developer, an organization looking to meet your climate goal, or simply want to stay informed, we're here to turn the complex into the comprehensible.

The tl;dr — four things to know in March 2024

New SEC rules require companies to disclose climate change-related information in their filings, including details of the carbon offsets used to achieve climate goals.

The Science Based Targets initiative (SBTi) released guidance on "beyond value chain mitigation" (BVCM), recommending companies to pursue activities to avoid, reduce, or remove greenhouse gas emissions (including using carbon credits) over and above those accounted for in their value chain.

Oxford University revises its well-known Oxford Offsetting Principles launched in 2020, reflecting the latest industry discussions and providing new guidance on how to improve existing carbon offset practices.

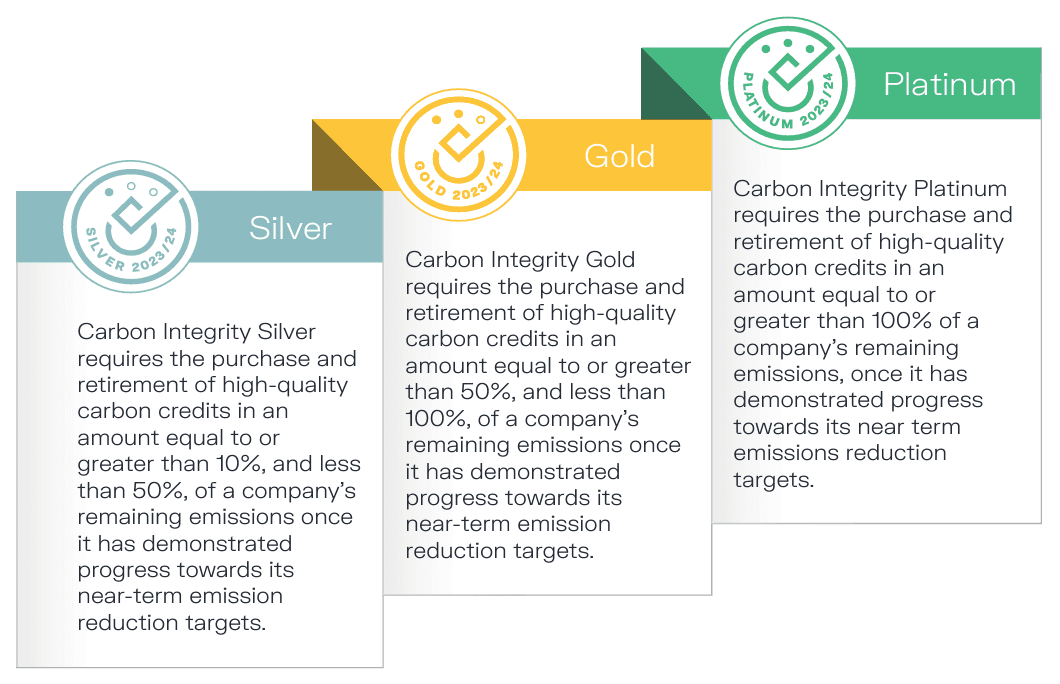

Bain & Company became the first organization globally to make a Carbon Integrity Platinum Claim under frameworks defined by the Voluntary Carbon Market Initiative (VCMI). This Platinum Claim requires them to purchase and retire carbon credits representing over 100% of their remaining emissions.

The new SEC climate rules 📋

On March 6, the US Securities and Exchange Commission (the “SEC”) finally announced new rules that require public companies to disclose climate change-related information in their filings (the decision was originally expected to be out last October). The final rules are a pared-down version of what was proposed two years ago but nonetheless represent one of the most comprehensive changes ever to SEC disclosure requirements.

Among all new disclosure requirements, the below are the most relevant to the carbon market:

Scope 1 and 2 Emissions Disclosure: Most large companies are now required to disclose their direct emissions (Scope 1) and indirect emissions from purchased electricity or energy (Scope 2).

Exclusion of Scope 3 emissions: Scope 3 emissions, which include all other indirect emissions in the value chain, are excluded due to concerns around data reliability and availability. This is widely considered the biggest retraction from the original draft.

Disclosure of Carbon Offset Use: If carbon offsets are used as a material component to achieve companies' climate goals, they are required to disclose the quantity, cost, and details (including project description, location, verifiers, etc.) of the carbon credits.

Unsurprisingly, there are plenty of challengers seeking to pause these rules in court. All eyes are on the court in determining their outcome. Meanwhile, we will be sharing further thoughts on the SEC climate rules soon – stay tuned!

2. SBTi’s guidance on “beyond value chain mitigation” 💡

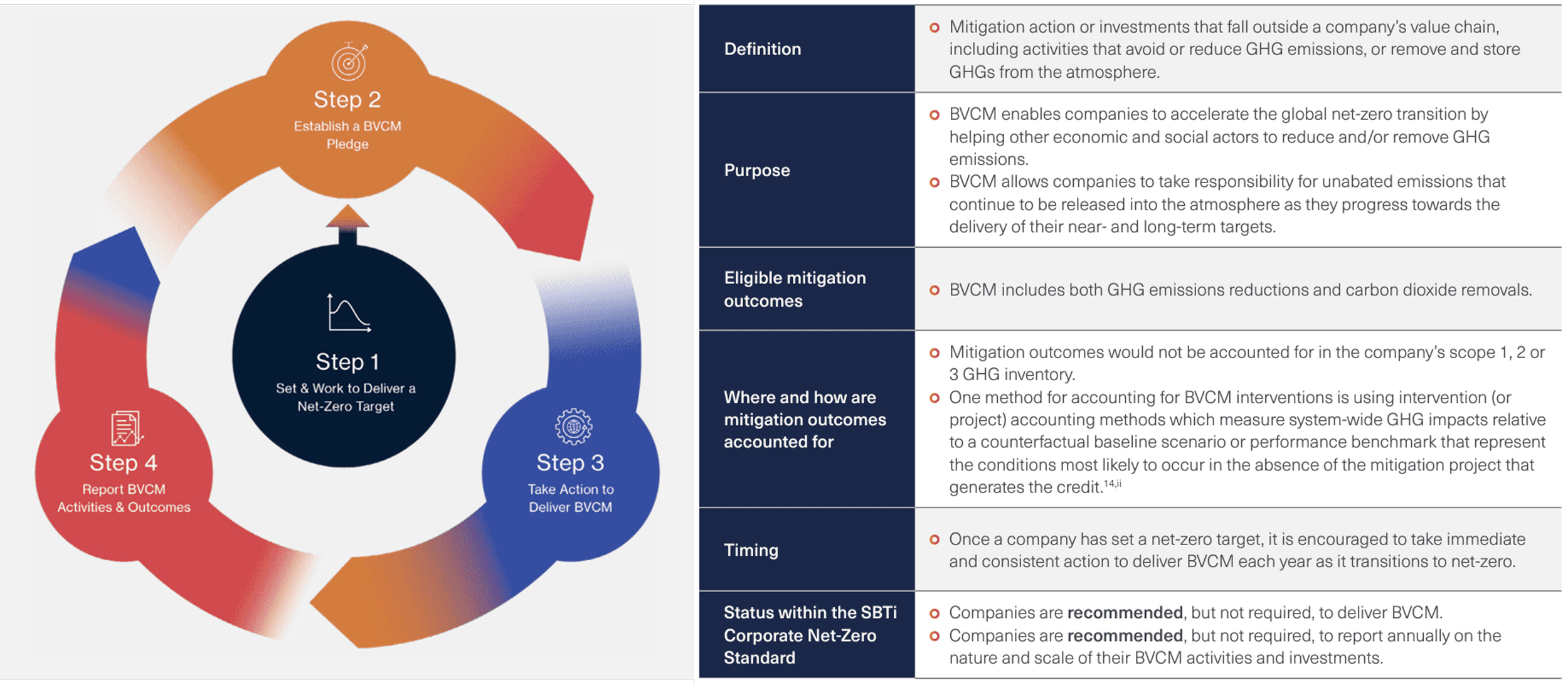

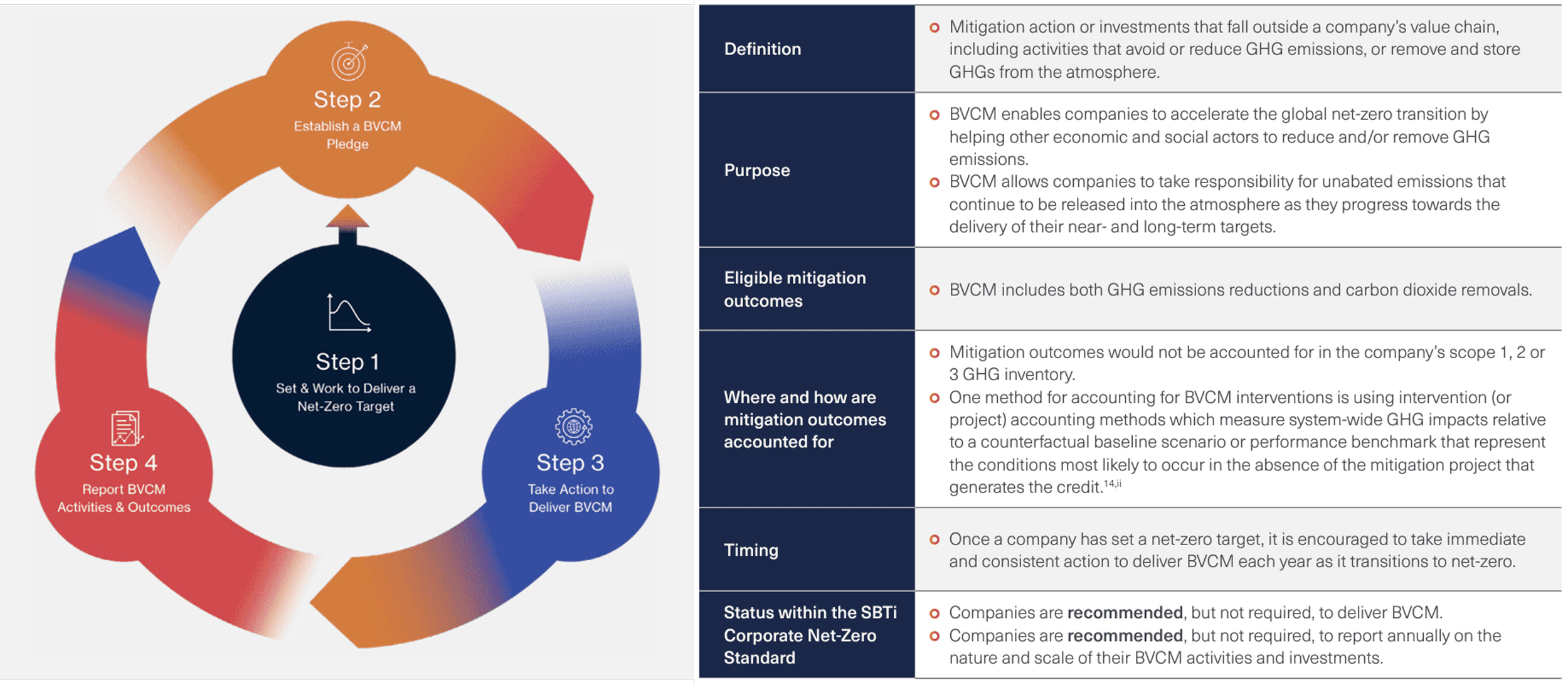

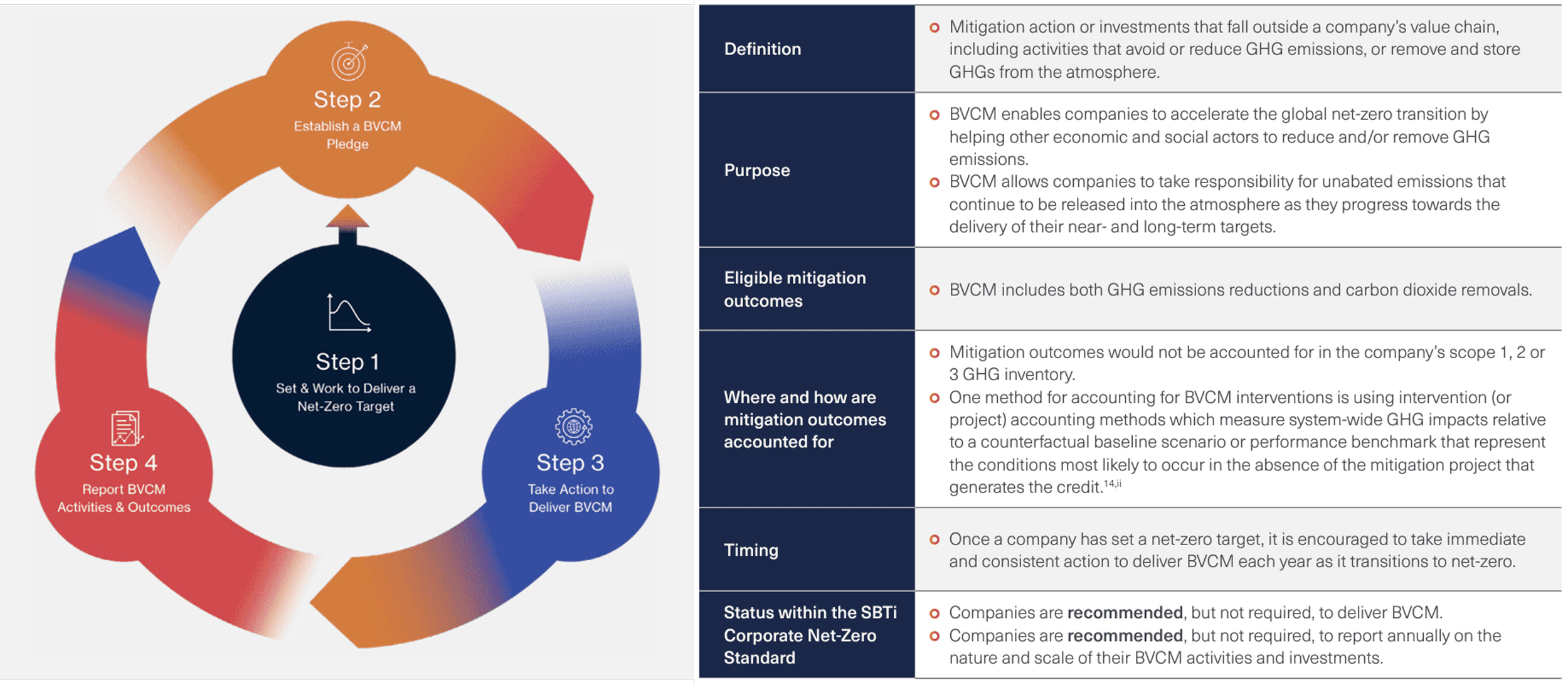

In late February, the Science Based Targets Initiative (SBTi), an organization that has validated over 4,000 companies and organizations’ net-zero climate goals, released new reports that provide guidance on “beyond value chain mitigation” (BVCM), a term that refers to activities that avoid, reduce, or remove greenhouse gas emissions outside a company’s value chain. Investing, purchasing, and retiring carbon credits is a way for organizations to deliver BVCM.

In the new guidance, SBTi recommends companies deliver BVCM above and beyond their emissions targets related to value-chain activities (typically referred to as “science-based targets”). It outlines the recommended process for companies to establish a BVCM pledge (see below). For now, SBTi does not plan to validate BVCM claims and reinforces that these activities are not counted toward SBTi-aligned emission reduction targets. The chart explains the steps and features in defining and implementing BVCM strategies:

Source: SBTi’s “Above and Beyond: An SBTI Report on the Design and Implementation of Beyond Value Chain Mitigation (BVCM)”, February 2024

NetaCarbon is encouraged by the new guidance, as it clarifies and reinforces the role of the voluntary carbon market for companies with an SBTi-validated climate goal. We also appreciate SBTi aligning its BVCM framework with the Carbon Integrity Claims proposed by the Voluntary Carbon Market Integrity Initiative (VCMI), another organization focusing specifically on claims related to the use of high-quality carbon credits. We believe harmonizing these guidelines will make it easier for companies to effectively engage the carbon market.

3. Revised Oxford Offsetting Principles ✒️

The University of Oxford, having published its well-recognized “The Oxford Principles for Net Zero Aligned Carbon Offsetting” in 2020, has revised and updated these Principles in late February 2024 to reflect the latest updates and discussions in the industry, and a renewed urgency to reduce emissions.

Specific updates include:

Reinforce that organizations should prioritize decarbonization within the value chain and use high-quality carbon credits for residual emissions

Emphasize the need to close the carbon removal gap – there is not enough high-quality removal and storage today

Highlight the importance of nature-based solutions in protecting ecosystems and biodiversity, irrespective of whether they are used to offset emissions

Recognize the many other reasons to purchase credits and support mitigation projects (such as co-benefits to society), over and above pure offsetting purposes.

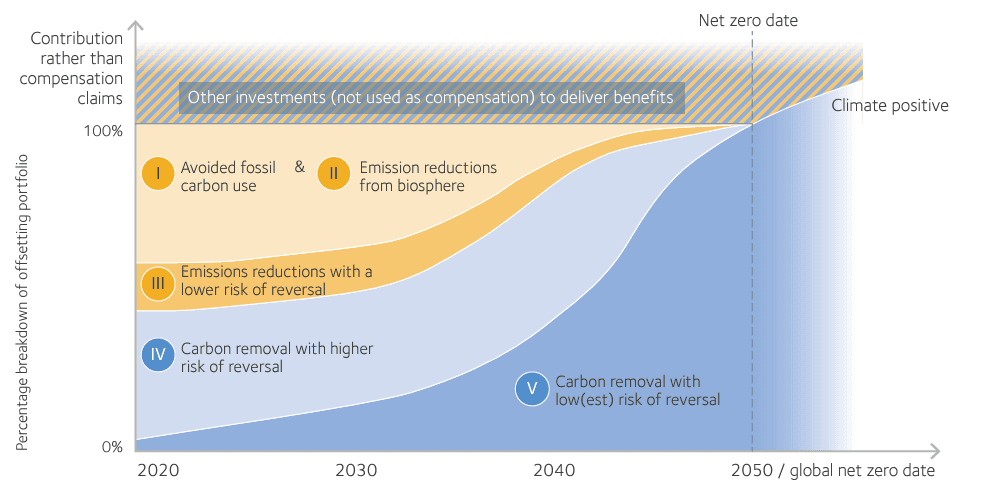

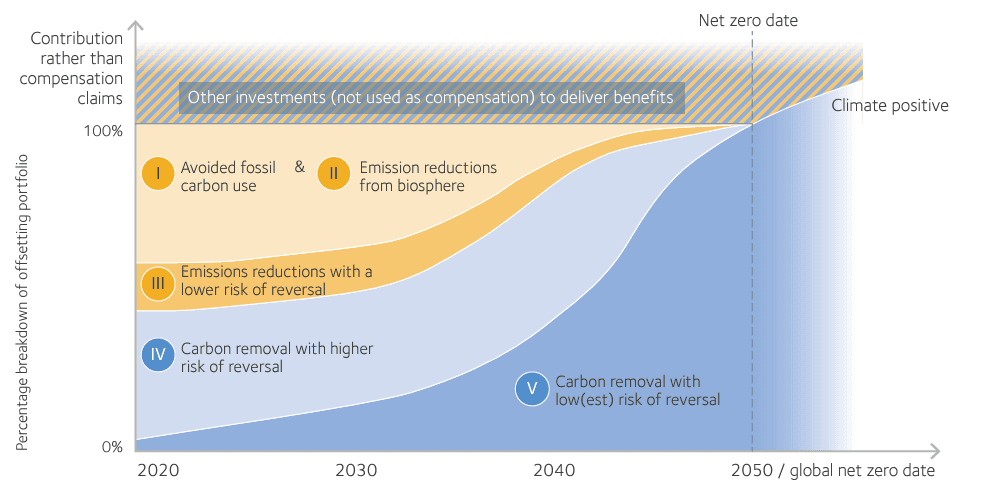

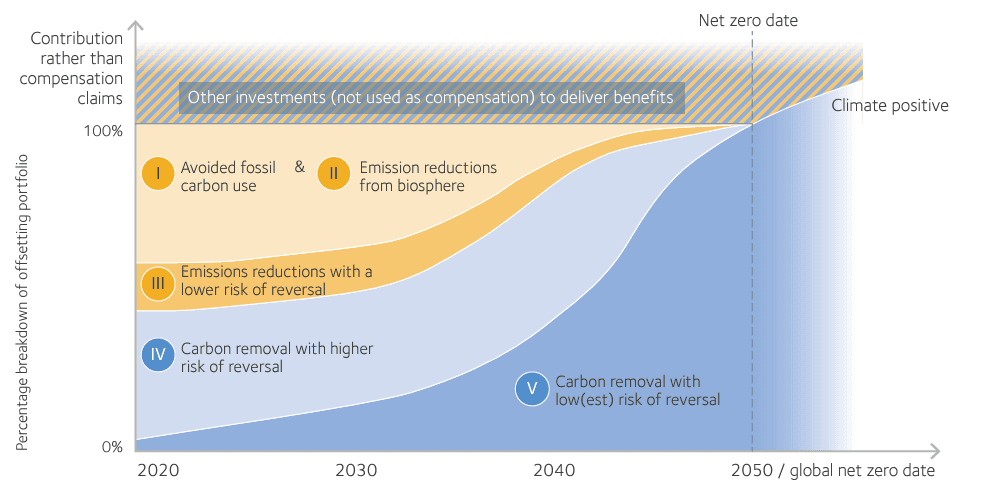

Based on these Principles, companies can construct a net-zero aligned offsetting portfolio across different categories, starting with a portfolio of emission avoidance and reduction projects now and shifting toward more permanent carbon removal projects in the future. Here is an example of an illustrative pathway:

Source: Oxford Principles for Net Zero Aligned Carbon Offsetting (Revised 2024), February 2024

4. First VCMI Carbon Integrity Platinum Claim 🏅

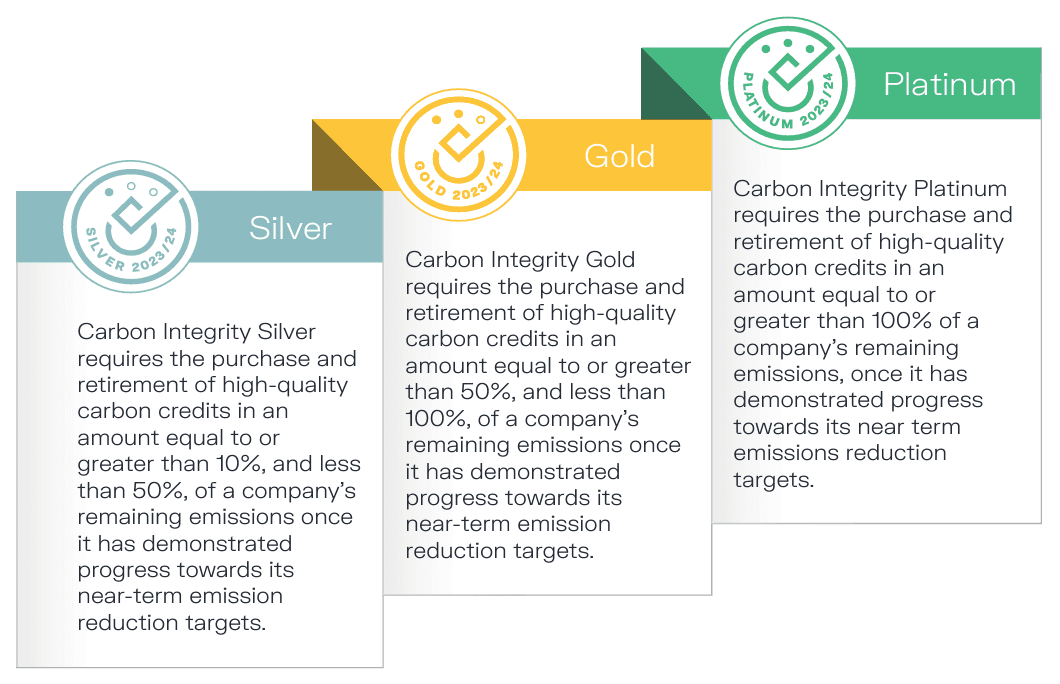

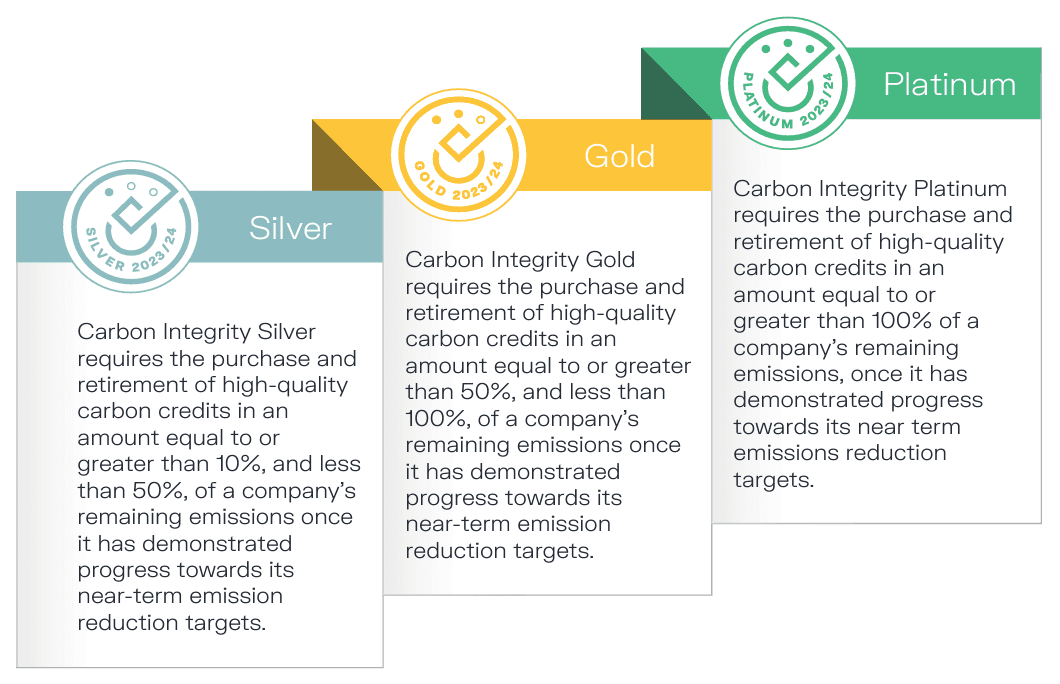

Continuing on the thread of VCMI – Bain & Company recently made headlines by becoming the first organization to make a Carbon Integrity Platinum Claim, the highest level on the claim list. A platinum claim requires an organization to purchase and retire carbon credits representing over 100% of a company’s remaining emissions.

Source: Voluntary Carbon Markets Integrity Initiative’s Claims Code of Practice, November 2023

The VCMI’s Claims Code of Practice provides rigor and clarity of what constitutes good carbon credit practices for companies with climate goals. In an interview, Bain’s Chief Sustainability Officer explains its move and highlights that the carbon credit strategy “should be last but not later” in the consulting firm’s sustainability strategy.

That’s it for now – we hope you enjoy this bite-size read to get up-to-speed on the latest developments in the carbon market! At NetaCarbon, our goal is to help you – a project developer or a climate-aligned organization – navigate the complex and changing voluntary carbon market landscape.

We would love to hear your feedback. If you have any suggestions or questions related to this blog post, please reach out and let us know.

The new SEC climate rules 📋

On March 6, the US Securities and Exchange Commission (the “SEC”) finally announced new rules that require public companies to disclose climate change-related information in their filings (the decision was originally expected to be out last October). The final rules are a pared-down version of what was proposed two years ago but nonetheless represent one of the most comprehensive changes ever to SEC disclosure requirements.

Among all new disclosure requirements, the below are the most relevant to the carbon market:

Scope 1 and 2 Emissions Disclosure: Most large companies are now required to disclose their direct emissions (Scope 1) and indirect emissions from purchased electricity or energy (Scope 2).

Exclusion of Scope 3 emissions: Scope 3 emissions, which include all other indirect emissions in the value chain, are excluded due to concerns around data reliability and availability. This is widely considered the biggest retraction from the original draft.

Disclosure of Carbon Offset Use: If carbon offsets are used as a material component to achieve companies' climate goals, they are required to disclose the quantity, cost, and details (including project description, location, verifiers, etc.) of the carbon credits.

Unsurprisingly, there are plenty of challengers seeking to pause these rules in court. All eyes are on the court in determining their outcome. Meanwhile, we will be sharing further thoughts on the SEC climate rules soon – stay tuned!

2. SBTi’s guidance on “beyond value chain mitigation” 💡

In late February, the Science Based Targets Initiative (SBTi), an organization that has validated over 4,000 companies and organizations’ net-zero climate goals, released new reports that provide guidance on “beyond value chain mitigation” (BVCM), a term that refers to activities that avoid, reduce, or remove greenhouse gas emissions outside a company’s value chain. Investing, purchasing, and retiring carbon credits is a way for organizations to deliver BVCM.

In the new guidance, SBTi recommends companies deliver BVCM above and beyond their emissions targets related to value-chain activities (typically referred to as “science-based targets”). It outlines the recommended process for companies to establish a BVCM pledge (see below). For now, SBTi does not plan to validate BVCM claims and reinforces that these activities are not counted toward SBTi-aligned emission reduction targets. The chart explains the steps and features in defining and implementing BVCM strategies:

Source: SBTi’s “Above and Beyond: An SBTI Report on the Design and Implementation of Beyond Value Chain Mitigation (BVCM)”, February 2024

NetaCarbon is encouraged by the new guidance, as it clarifies and reinforces the role of the voluntary carbon market for companies with an SBTi-validated climate goal. We also appreciate SBTi aligning its BVCM framework with the Carbon Integrity Claims proposed by the Voluntary Carbon Market Integrity Initiative (VCMI), another organization focusing specifically on claims related to the use of high-quality carbon credits. We believe harmonizing these guidelines will make it easier for companies to effectively engage the carbon market.

3. Revised Oxford Offsetting Principles ✒️

The University of Oxford, having published its well-recognized “The Oxford Principles for Net Zero Aligned Carbon Offsetting” in 2020, has revised and updated these Principles in late February 2024 to reflect the latest updates and discussions in the industry, and a renewed urgency to reduce emissions.

Specific updates include:

Reinforce that organizations should prioritize decarbonization within the value chain and use high-quality carbon credits for residual emissions

Emphasize the need to close the carbon removal gap – there is not enough high-quality removal and storage today

Highlight the importance of nature-based solutions in protecting ecosystems and biodiversity, irrespective of whether they are used to offset emissions

Recognize the many other reasons to purchase credits and support mitigation projects (such as co-benefits to society), over and above pure offsetting purposes.

Based on these Principles, companies can construct a net-zero aligned offsetting portfolio across different categories, starting with a portfolio of emission avoidance and reduction projects now and shifting toward more permanent carbon removal projects in the future. Here is an example of an illustrative pathway:

Source: Oxford Principles for Net Zero Aligned Carbon Offsetting (Revised 2024), February 2024

4. First VCMI Carbon Integrity Platinum Claim 🏅

Continuing on the thread of VCMI – Bain & Company recently made headlines by becoming the first organization to make a Carbon Integrity Platinum Claim, the highest level on the claim list. A platinum claim requires an organization to purchase and retire carbon credits representing over 100% of a company’s remaining emissions.

Source: Voluntary Carbon Markets Integrity Initiative’s Claims Code of Practice, November 2023

The VCMI’s Claims Code of Practice provides rigor and clarity of what constitutes good carbon credit practices for companies with climate goals. In an interview, Bain’s Chief Sustainability Officer explains its move and highlights that the carbon credit strategy “should be last but not later” in the consulting firm’s sustainability strategy.

That’s it for now – we hope you enjoy this bite-size read to get up-to-speed on the latest developments in the carbon market! At NetaCarbon, our goal is to help you – a project developer or a climate-aligned organization – navigate the complex and changing voluntary carbon market landscape.

We would love to hear your feedback. If you have any suggestions or questions related to this blog post, please reach out and let us know.

The new SEC climate rules 📋

On March 6, the US Securities and Exchange Commission (the “SEC”) finally announced new rules that require public companies to disclose climate change-related information in their filings (the decision was originally expected to be out last October). The final rules are a pared-down version of what was proposed two years ago but nonetheless represent one of the most comprehensive changes ever to SEC disclosure requirements.

Among all new disclosure requirements, the below are the most relevant to the carbon market:

Scope 1 and 2 Emissions Disclosure: Most large companies are now required to disclose their direct emissions (Scope 1) and indirect emissions from purchased electricity or energy (Scope 2).

Exclusion of Scope 3 emissions: Scope 3 emissions, which include all other indirect emissions in the value chain, are excluded due to concerns around data reliability and availability. This is widely considered the biggest retraction from the original draft.

Disclosure of Carbon Offset Use: If carbon offsets are used as a material component to achieve companies' climate goals, they are required to disclose the quantity, cost, and details (including project description, location, verifiers, etc.) of the carbon credits.

Unsurprisingly, there are plenty of challengers seeking to pause these rules in court. All eyes are on the court in determining their outcome. Meanwhile, we will be sharing further thoughts on the SEC climate rules soon – stay tuned!

2. SBTi’s guidance on “beyond value chain mitigation” 💡

In late February, the Science Based Targets Initiative (SBTi), an organization that has validated over 4,000 companies and organizations’ net-zero climate goals, released new reports that provide guidance on “beyond value chain mitigation” (BVCM), a term that refers to activities that avoid, reduce, or remove greenhouse gas emissions outside a company’s value chain. Investing, purchasing, and retiring carbon credits is a way for organizations to deliver BVCM.

In the new guidance, SBTi recommends companies deliver BVCM above and beyond their emissions targets related to value-chain activities (typically referred to as “science-based targets”). It outlines the recommended process for companies to establish a BVCM pledge (see below). For now, SBTi does not plan to validate BVCM claims and reinforces that these activities are not counted toward SBTi-aligned emission reduction targets. The chart explains the steps and features in defining and implementing BVCM strategies:

Source: SBTi’s “Above and Beyond: An SBTI Report on the Design and Implementation of Beyond Value Chain Mitigation (BVCM)”, February 2024

NetaCarbon is encouraged by the new guidance, as it clarifies and reinforces the role of the voluntary carbon market for companies with an SBTi-validated climate goal. We also appreciate SBTi aligning its BVCM framework with the Carbon Integrity Claims proposed by the Voluntary Carbon Market Integrity Initiative (VCMI), another organization focusing specifically on claims related to the use of high-quality carbon credits. We believe harmonizing these guidelines will make it easier for companies to effectively engage the carbon market.

3. Revised Oxford Offsetting Principles ✒️

The University of Oxford, having published its well-recognized “The Oxford Principles for Net Zero Aligned Carbon Offsetting” in 2020, has revised and updated these Principles in late February 2024 to reflect the latest updates and discussions in the industry, and a renewed urgency to reduce emissions.

Specific updates include:

Reinforce that organizations should prioritize decarbonization within the value chain and use high-quality carbon credits for residual emissions

Emphasize the need to close the carbon removal gap – there is not enough high-quality removal and storage today

Highlight the importance of nature-based solutions in protecting ecosystems and biodiversity, irrespective of whether they are used to offset emissions

Recognize the many other reasons to purchase credits and support mitigation projects (such as co-benefits to society), over and above pure offsetting purposes.

Based on these Principles, companies can construct a net-zero aligned offsetting portfolio across different categories, starting with a portfolio of emission avoidance and reduction projects now and shifting toward more permanent carbon removal projects in the future. Here is an example of an illustrative pathway:

Source: Oxford Principles for Net Zero Aligned Carbon Offsetting (Revised 2024), February 2024

4. First VCMI Carbon Integrity Platinum Claim 🏅

Continuing on the thread of VCMI – Bain & Company recently made headlines by becoming the first organization to make a Carbon Integrity Platinum Claim, the highest level on the claim list. A platinum claim requires an organization to purchase and retire carbon credits representing over 100% of a company’s remaining emissions.

Source: Voluntary Carbon Markets Integrity Initiative’s Claims Code of Practice, November 2023

The VCMI’s Claims Code of Practice provides rigor and clarity of what constitutes good carbon credit practices for companies with climate goals. In an interview, Bain’s Chief Sustainability Officer explains its move and highlights that the carbon credit strategy “should be last but not later” in the consulting firm’s sustainability strategy.

That’s it for now – we hope you enjoy this bite-size read to get up-to-speed on the latest developments in the carbon market! At NetaCarbon, our goal is to help you – a project developer or a climate-aligned organization – navigate the complex and changing voluntary carbon market landscape.

We would love to hear your feedback. If you have any suggestions or questions related to this blog post, please reach out and let us know.

Since you made it this far, why not sign up for our newsletter?

Since you made it this far, why not sign up for our newsletter?

Make smarter

packaging decisions

See how we can cut your time spent on packaging compliance and data tracking by half

Make smarter

packaging decisions

See how we can cut your time spent on packaging compliance and data tracking by half

Make smarter

packaging decisions

See how we can cut your time spent on packaging compliance and data tracking by half